portability real estate taxes florida

If you moved to Hillsborough County from another Florida County provide the most complete address you can and be sure to. If you do not have property in Martin County enter 0 in both the Market Value and.

Irs Now Allows For 5 Year Estate Tax Portability Election

Video by Tommy Forcella 10252017.

. When buying real estate property do not assume property taxes will remain the same. When someone owns property and makes it his or her permanent residence or the permanent. An additional 25000 homestead exemption is applied to homesteads that.

Apply for Portability when you apply for Homestead Exemption on your new property. Previous Property selling or sold To find your current market value or assessed value click here for details. Each county sets its own tax rate.

If a homestead property is sold or transferred in calendar year 2022 the homestead tax benefits including the Cap Benefit remains with that property until. Before portability came along some. Will be applied to the assessed value of the new homesteaded property in the year that the portability.

How does homestead portability work. Florida Statutes Even if the value of your home decreases the assessed value may increase but only by this limited amount. Homestead portability allows the transfer of homestead assessment benefits from your previous homestead property to your new home.

1 2008 and has become important given the decade-long runup in Florida property values. The average property tax rate in Florida is 083. 1 It applies solely to homestead changes in 2007 or later.

The Property Appraiser maintains the ownership mailing address and legal. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer. If you already own another property 2nd home beach house etc and establish your new homestead you can remove abandon the homestead from the old.

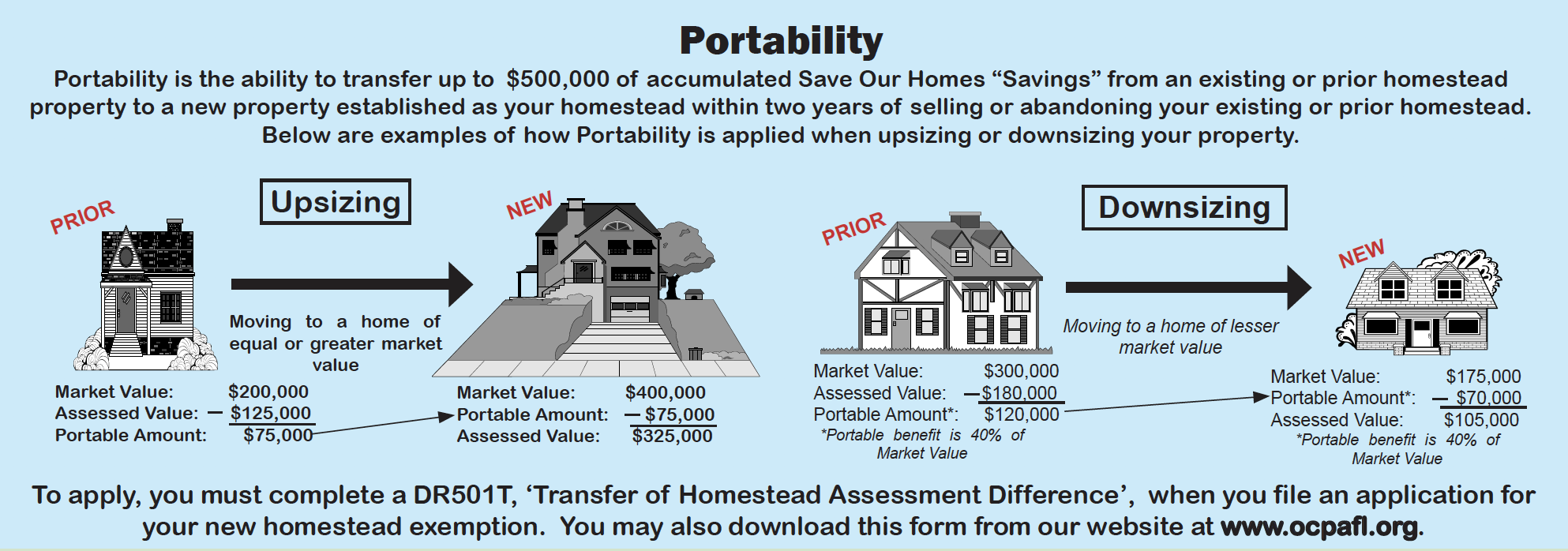

On the Real Estate Tax Bill or use the parcel record search. In Florida Property Tax Portability refers to the ability to transfer up to 500000 of accumulated Save Our Homes Cap Savings from an. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home.

Portability went into effect on Jan. There are also special tax districts such as schools and water management districts that. The assessed value will never be more than the just value of your.

2 At least one owner from the previous homestead property must be an owner of the new homestead property. If our office denies your portability application you will have an opportunity to file an appeal with Palm. In the previous example if the homeowner purchases a larger home with a justmarket value of 300000 portability allows for a reduction in taxable value by the 58000.

Portability is the ability to transfer up to 500000 of accumulated Save Our Homes assessment difference from a prior Florida homesteaded property to a new. Florida property owners can receive a 25000 property tax exemption for their primary residence. Real Estate and Tangible Personal Property tax rolls are prepared by the Orange County Property Appraisers Office.

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Florida Homestead Check For Homeowners

Estate Planning With Portability In Mind Part Ii The Florida Bar

Southwest Florida Real Estate Taxes Southwest Fl Dave Sage Brenda Boss Sagerealtor Com

Understanding Florida S Homestead Exemption Laws Florida Realtors

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

/arc-anglerfish-arc2-prod-tbt.s3.amazonaws.com/public/R76EFPWHBMI6TBKNIBWI6S7HAY.jpg)

Portability Benefit Can Reduce Tax Burden For Property Owners Moving Into Larger Or Smaller Homes

Homestead Portability What Is It And Should I Apply For It Us Patriot Title

Real Estate License Reciprocity Portability Guide

Estate Planning With Portability In Mind Part Ii The Florida Bar

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

If Your Home Is Under The Protection Of The Homestead Exemptions Save Our Home Cap Then You May Be Able To Use Yo Homestead Property Property Tax How To Apply

About Florida Homestead Check Explaining Florida S Homestead Laws

Homestead Portability Transferring Your Florida Homestead Cap To Your New Home Infinity Realty Group

About Florida Homestead Check Explaining Florida S Homestead Laws

Florida Tax Portability Easy Explanation With Lisa Fox Youtube